Picture waking up in a house that is truly yours, where you can make memories, plan for the future, and take advantage of the security that comes with being a homeowner.

Purchasing a home and land is one of the most significant business choices you will ever make, but it can also be one of the most fulfilling.

Making the correct decisions early on is crucial to avoiding expensive errors.

If you’re ready to take this exciting step, now is the perfect time to prepare. With the proper knowledge, you can confidently navigate the process and secure a home that fits your budget and lifestyle.

In this guide, we’ll share essential tips on buying a house and lot in the Philippines so you can make an informed decision.

Whether purchasing your first home or upgrading to a better one, these insights will help you find the perfect place to call your own.

Your ideal house is just waiting for you; let’s ensure you acquire it properly!

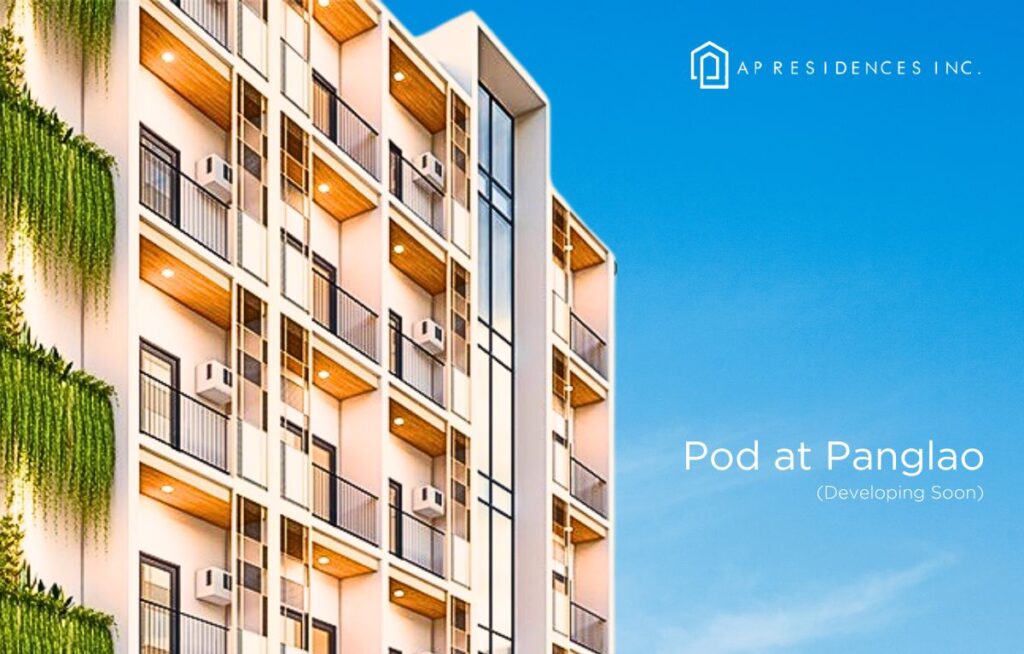

Find Your Dream Home with AP Residences

Know Your Budget and Financing Options

One of the largest purchases you will ever make is a home, therefore budgeting is essential. Your housing expenses, including taxes, fees, and loan payments, should ideally not surpass 30% of your monthly income.

This guarantees that you can afford your house and yet have money for savings, emergencies, and everyday needs.

Explore Financing Options

Most homebuyers in the Philippines rely on financing. Here are three standard options:

- Bank Loans – These are the best option for people with steady incomes and excellent credit because they have affordable interest rates.

- Pag-IBIG Housing Loan – The government-backed Pag-IBIG Housing Loan offers longer terms and reduced interest rates, making housing more accessible.

- In-House Financing – Developers offer in-house financing, which is easier to approve but frequently has higher interest rates.

Plan for Additional Costs

Beyond the price of the house, factor in transfer taxes, registration fees, and move-in costs. Monthly expenses like utilities, association dues, and maintenance should also be considered to avoid financial surprises.

When looking for tips on buying a house and lot in the Philippines, start with a strong financial plan. Being prepared means purchasing a home you can afford while securing your future.

Choose the Right Location

Where the house is should be the top priority. No matter how beautiful a home is, the wrong location can lead to daily inconveniences and lower property value.

One of the top tips for buying a house and lot in the Philippines is choosing a place that fits your lifestyle and plans.

- Location is Key—A crucial aspect of buying a house and lot in the Philippines is knowing the crucial locations in your locality. Did you know that prices of commodity and overall quality of life depends on where you live?

- Prioritize Convenience – Living near workplaces, hospitals, schools, and shopping malls can save time and lower stress. Easy access to public transportation and major roads ensures hassle-free commuting.

- Ensure Safety – Check the neighborhood’s history of flooding, crime rates, and overall environment. Visit the area at different times of the day to get a true feel of its atmosphere.

- Consider Future Growth – Properties near upcoming business hubs or infrastructure projects tend to increase in value. Investing in a well-located home can bring long-term financial benefits.

- Make an Informed Decision—A great home in the right area offers comfort, security, and peace of mind. Research and visit potential locations to ensure your investment is truly worth it.

Verify the Developer’s Credibility

One of the key tips on buying a house and lot in the Philippines is choosing a trusted developer. A reputable developer ensures quality construction, timely delivery, and a hassle-free home buying process. To avoid risks, consider these steps:

- Research their track record – Check completed projects, customer feedback, and any history of delays or complaints.

- Visit existing communities – See if their developments are well-maintained and if homeowners are satisfied.

- Verify legal documents – Ensure the property has the proper permits and a clean title. Look for HLURB or DHSUD approval.

- Check transparency – A trustworthy developer is upfront about costs, ownership, and the home buying process.

Buying from a reliable developer like AP Residences means securing a quality home in a prime location. Don’t just buy a house—invest in a future with peace of mind.

Understand the Property Type That Fits Your Needs

One essential tip on buying a house and lot in the Philippines is selecting a property that aligns with your lifestyle and future goals.

While condos and townhouses offer convenience, owning a house and lot provides greater freedom, space, and long-term value.

A house and lot give you more privacy and the flexibility to expand or customize your home. Unlike condos with strict regulations and rising association fees, homeownership allows complete control over your property.

Whether you need extra rooms, a backyard, or additional parking, a house and lot provide the space to grow without restrictions.

With real estate values steadily increasing, now is an ideal investment time. Delaying your purchase may lead to higher prices and limited options.

Inspect the Property Before Buying

One of the most crucial tips for buying a house and lot in the Philippines is to inspect the property before committing.

Photos and brochures can be misleading, so seeing the house in person helps you spot potential issues and assess if it meets your needs.

Here’s what to check during your visit:

- Structural Quality – Look for cracks, leaks, or uneven floors. These may indicate poor construction or hidden damage that could lead to expensive repairs.

- Materials Used – Examine the walls, doors, and roofing. Are they sturdy and well-maintained? A well-built home ensures long-term durability and safety.

- Ventilation and Natural Lighting – A comfortable home should have good airflow and enough natural light to reduce electricity costs.

- Location and Accessibility – Is the property near schools, hospitals, markets, and transport hubs? A well-placed home makes daily life more convenient and boosts property value.

- Neighborhood and Security—Walk around the community. Is it peaceful and safe? Are security measures in place, like guards or CCTV cameras?

- Developer Reputation—If you’re buying a pre-selling unit, research the developer’s track record. Visit their completed projects to check the quality of their work.

A house is a long-term investment, so take the time to inspect, ask questions, and make an informed decision. The right home concerns affordability, security, comfort, and future growth.

Read the Contract and Fine Print Carefully

One of the most crucial tips on buying a house and lot in the Philippines is to read and understand the contract before signing anything.

Many homebuyers get too excited about owning a property and overlook the fine print, only to face unexpected fees or strict policies later.

Before you commit, consider the payment terms, interest rates, and late payment penalties.

Are there any maintenance expenses, association dues, or hidden fees?

Clarify everything with the developer to avoid surprises. Never be afraid to ask questions or seek legal counsel if anything is unclear.

Purchasing a property is a significant commitment, and the last thing you want is to be subjected to unfavorable terms.

By being meticulous with your contract, you can safeguard yourself against monetary hazards and guarantee a seamless homeownership experience.

Take your time; your ideal house should bring comfort rather than anxiety.

Secure the Documents

One of the most essential tips on buying a house and lot in the Philippines is securing the necessary documents to avoid legal issues, ownership disputes, or hidden liabilities.

Overlooking this step can lead to costly mistakes that may put your investment at risk.

Here are the key documents you need to verify before finalizing your purchase:

- Title of the Property – Obtain a Certified True Copy from the Registry of Deeds to confirm the seller’s ownership and check for encumbrances such as loans, mortgages, or legal disputes.

- Tax Declaration – Ensure that real estate taxes are up to date. Unpaid taxes may become your responsibility after purchasing the property.

- License to Sell and Certificate of Registration—If you are buying from a developer, verify these documents with the Housing and Land Use Regulatory Board (HLURB) to ensure the project is legally registered.

- Building and Occupancy Permits – Confirm that the structure has the necessary permits for house and lot purchases, proving it meets safety and legal standards.

- Deed of Sale – This legally binds the sale between you and the seller. It must be notarized to be valid.

- Loan Agreement and Mortgage Contract – If buying through a bank loan, ensure that all financing documents are properly executed to avoid future disputes.

To protect yourself further, consider consulting a real estate lawyer to review these documents. Doing so ensures your purchase is legal, secure, and free from unexpected problems, giving you peace of mind in your investment.

Buying a house and lot in the Philippines is a significant investment, and making informed decisions can save you from costly mistakes.

By following these tips on buying a house and lot in the Philippines, you can ensure a smoother purchasing process and protect your hard-earned money.

Always research the developer, verify property documents, and assess the location’s long-term value. Understanding financing options and transaction costs will also help you budget wisely.

Most importantly, never rush into a deal without due diligence. Evaluating your choices will lead to a home that meets your needs and secures your future.

With careful planning and informed decision-making, you can confidently invest in a property that provides comfort, security, and lasting value.